The Fine Wine Market in 2025: Signs of Stability and Opportunity

After several challenging years, 2025 has marked an important turning point for the fine wine market. While the year has not delivered a full recovery, it has brought something equally valuable: stability, renewed confidence, and selective opportunity. According to Liv-ex market data, the secondary fine wine market appears to be finding its footing after a prolonged correction.

A Year of Two Halves

The year began with cautious optimism. Trade volumes and values improved early on, reflecting a long overdue clearing of excess stock built up during the post-pandemic boom. However, sentiment was abruptly shaken in March when the threat, and later confirmation, of US tariffs on European wine caused American buyers to withdraw almost overnight.

The impact was immediate. Prices weakened sharply through spring and early summer, particularly in regions heavily dependent on US demand such as Champagne and Italy. A lacklustre Bordeaux En Primeur campaign further dampened confidence, pushing the market into a familiar mid-year lull.

Yet, from September onwards, the narrative began to change.

Stabilisation and Improving Sentiment

For the first time in three years, the major Liv-ex indices recorded consecutive monthly gains in the second half of the year. While total trade value for 2025 remains slightly below 2024 levels, volumes are notably higher. This is an important signal that buyers are active again, albeit at more disciplined price points.

Bid to offer ratios, a key indicator of market sentiment, have steadily improved. This suggests that buyers and sellers are gradually realigning expectations, laying the groundwork for a more sustainable recovery rather than a speculative rebound.

Europe Steps In as the US Steps Back

With US demand muted by tariffs and currency weakness, European buyers have emerged as the dominant force in 2025. European purchase value is up sharply year on year, helping to offset the decline from across the Atlantic.

This shift has been especially beneficial for Italy. Despite a steep drop in US buying, overall Italian trade value has remained resilient, supported by strong European demand for Tuscan wines. This resilience reinforces Italy’s reputation as one of the most balanced and dependable regions in the fine wine market.

Buyer Demographics and Regional Shifts

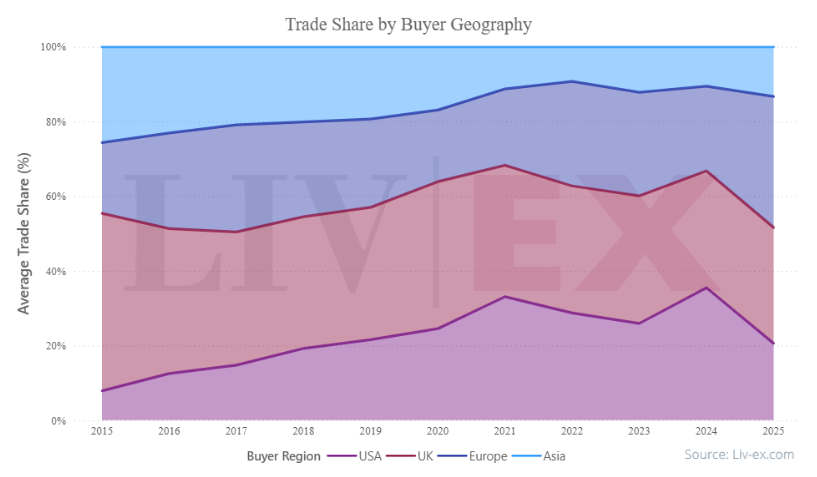

The chart above highlights one of the most important structural changes in the 2025 market. As US participation fell sharply following the introduction of tariffs, European buyers increased their share of global fine wine trade significantly. At the same time, Asian demand, while still uneven, has begun to show early signs of recovery.

This rebalancing of buyer demographics has played a crucial role in stabilising prices and sustaining liquidity across key regions, particularly Italy and Bordeaux.

What This Means for Collectors and Investors

The fine wine market of 2025 is no longer defined by rapid price appreciation. Instead, it is characterised by selectivity, value, and long term thinking. Prices at the top end appear to have stabilised, while the broader market offers compelling opportunities for collectors willing to focus on quality, provenance, and drinkability rather than short term gains.

Looking ahead to 2026, the market is expected to remain cautious but constructive. If US tariffs ease and Asian demand continues to strengthen, the foundations laid in 2025 could support a more decisive recovery.

A Moment to Engage with Fine Wine

Periods like this are often the most attractive entry points for committed collectors. With prices more rational and availability strong, the current market favours those buying to build meaningful cellars: wines to enjoy, share, and hold with confidence.

At Vinho, we continue to monitor these developments closely, guiding our clients through a market that is no longer overheated, but once again grounded in fundamentals.

Here’s to another year of informed investing and enduring wines. 🍷